2 Linear Regression

This chapter is about linear regression, a very simple approach for supervised learning. In particular, linear regression is a useful tool for predicting a quantitative response. Linear regression has been around for a long time and is the topic of innumerable textbooks. Though it may seem somewhat dull compared to some of the more modern statistical learning approaches described in later chapters of this book, linear regression is still a useful and widely used statistical learning method. Moreover it serves as a good jumping-off point for newer approaches: as we will see in later chapters, many fancy statistical learning approaches can be seen as generalizations or extensions of linear regression. Consequently, the importance of having a good understanding of linear regression before studying more complex learning methods cannot be overstated. In this chapter, we review some of the key ideas of the linear regression model, as well as the least squares approach that is most commonly used to fit this model.

Recall the Advertising data from Chapter 2.

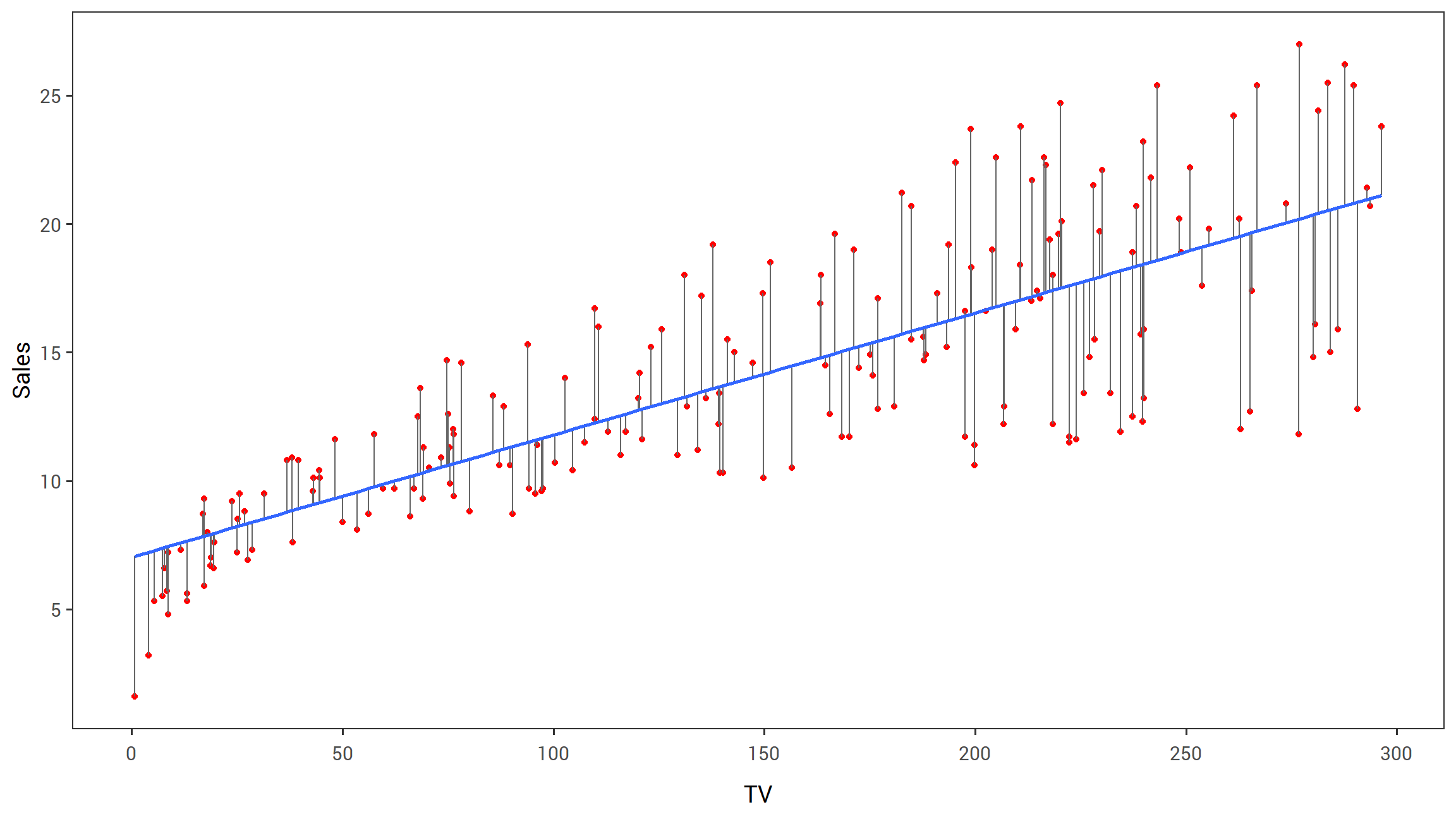

Figure 2.1 displays sales (in thousands of units) for a particular product as a function of advertising budgets (in thousands of dollars) for TV, radio, and newspaper media.

Suppose in our role as statistical consultants we are asked to suggest, on the basis of this data, a marketing plan for next year that will result in high product sales.

What information would be useful in order to provide such a recommendation?

Here are a few important questions that we might seek to address:

Is there a relationship between advertising budget and sales?

Our first goal should be to determine whether the data provide evidence of an association between advertising expenditure and sales. If the evidence is weak, then one might argue no money should be spent on advertising!How strong is the relationship between advertising budget and sales?

Assuming there is a relationship between advertising and sales, we would like to know the strength of that relationship. In other words, given a certain advertising budget, can we predict sales with a high level of accuracy? This would be a strong relationship. Or is a prediction of sales based on advertising expenditure only slightly better than a random guess? This would be a weak relationship.Which media contribute to sales?

Do all three media - TV, radio, and newspaper - contribute to sales, or do only one or two of the media contribute? To answer this question, we must find a way to separate out the individual effects of each medium when we have spent the mony on all three media.How accurately can we estimate the effect of each medium on sales?

For every dollar spent on advertising in a particular medium, by what amount will sales increase? How accurately can we predict this amount of increase?How accurately can we predict future sales?

For every given level of television, radio, and newspaper sales, what is our prediction for sales, and what is the accuracy of this prediction?Is the relationship linear?

If there is an approximately straight-line relationship between advertising expenditure in the various media and sales, then linear regression is an appropriate tool. If not, then it may still be possible to transform the predictor of the response so that linear regression can be used.Is there synergy among the advertising media?

Perhaps spending $50,000 on television advertising and $50,000 on radio advertising results in more sales than allocating $100,000 in either television or radio individually. In marketing, this is known as a synergy effect, while in statistics it is called an interaction effect.

It turns out that linear regression can be used to answer each of these questions. We will first discuss all of these questions in a general context, and then return to them in this specific context in Section 3.4.

2.1 Simple Linear Regression

Simple linear regression lives up to its name: it is a very straightforward approach for predicting a quantitative response Y on the basis of a single predictor variable X. It assumes that there is an approximately linear relationship between X and Y. Mathematically we can write this linear relationship as

\[\begin{equation} Y \approx \beta_0 + \beta_1X \tag{2.1} \end{equation}\]

You might read “\(\approx\)” as “is approximately modeled as”.

We will sometimes describe (2.1) by saying we are regressing Y on X (or Y onto X).

For example, X may represent TV advertising and Y may represent sales.

Then we can regress sales onto TV by fitting the model:

\[ \color{#B44C1C}{\textbf{sales}} = \beta_0+\beta_1\times\color{#B44C1C}{\textbf{TV}} \]

In Equation (2.1), \(\beta_0\) and \(\beta_1\) are two unknown constants that represent the intercept and the slope terms in the linear model. Together, \(\beta_0\) and \(\beta_1\) are known as the model coefficients or parameters. Once we have used our training data to produce estimates \(\hat{\beta_0}\) and \(\hat{\beta_1}\) for our model parameters, we can predict future sales on the basis of a particular value of TV advertising by computing

\[\begin{equation} \hat{y} = \hat{\beta_0} + \hat{\beta_1}x \tag{2.2} \end{equation}\]

where \(\hat{y}\) indicates a prediction of \(Y\) on the basis of \(X=x\). Here we use the hat symbol, ^ , to denote the estimated value of an unknown parameter or coefficient, or to denote the predicted value of the response.

2.1.1 Estimating the Coefficients

In practice, \(\beta_0\) and \(\beta_1\) are unknown. So before we can use (2.1) to make predictions, we must use data to estimate the coefficients. Let

\[(x_1, y_1), (x_2, y_2), ..., (x_n, y_n)\]

represent n observation pairs, each of which consists of a measurement of X and a measurement of Y.

In the Advertising example, this data set consists of the TV advertising budget and product sales in \(n = 200\) different markets.

(Recall that the data are displayed in Figure 2.1.)

Our goal is to obtain coefficient estimates \(\hat{\beta_0}\) and \(\hat{\beta_1}\) such that the linear model (2.1) fits the available data well—that is, so that \(y_i \approx \hat{\beta_0}+\hat{\beta_1}x_i\) for \(i = 1,...,n\).

In other words, we want to find an intercept b0 and a slope b1 such that the resulting line is as close as possible to the \(n = 200\) data points.

There are a number of ways of measuring closeness.

However, by far the most common approach involves minimizing the least squares criterion, and we take that approach in this chapter.

Alternative approaches will be considered in Chapter 6.

# Fit linear model regressing Sales on TV

adv_lm = lm(sales~TV, advertising)

# Add the predicted values to the advertising dataframe

advertising %>%

mutate(predicted = adv_lm$fitted.values) %>%

ggplot(., aes(x=TV, y = sales))+

geom_point(colour = "red")+

geom_segment(aes(xend = TV, yend = predicted), colour = "grey40")+

stat_smooth(method = "lm", se = F, fullrange = T)+

scale_x_continuous(n.breaks = 6)+

scale_y_continuous(breaks = c(5,10,15,20,25))+

labs(y = "Sales")+

theme_islr()

FIGURE 2.1: For the Advertising data, the least squares fit for the regression of sales onto TV is shown. The fit is found by minimizing the sum of squared errors. Each grey line segment represents an error, and the fit makes a compromise by averaging their squares. In this case a linear fit captures the essence of the relationship, although it is somewhat deficient in the left of the plot.

Let \(\hat{y_i} = \hat{\beta_0}+\hat{\beta_1}x_i\) be the prediction for \(Y\) based on the ith value of \(X\). Then \(e_i = y_i - \hat{y_i}\) represents the ith residual—this is the difference between the ith observed response value and the ith response value that is predicted by our linear model. We define the residual sum of squares (RSS) as \[RSS = {e_1^2}+{e_2^2}+...+{e_n^2},\] or equivalently as

\[\begin{equation} RSS = (y_1 - \hat{\beta_0} - \hat{\beta_1}x_1)^2 + (y_2 - \hat{\beta_0} - \hat{\beta_1}x_2)^2 + ... + (y_n - \hat{\beta_0} - \hat{\beta_1}x_n)^2. \tag{2.3} \end{equation}\]

The least squares approach chooses \(\hat{\beta_0}\) and \(\hat{\beta_1}\) to minimize the RSS. Using some calculus, one can show that the minimizers are

\[\begin{equation} \begin{aligned} \hat{\beta_1} &= \frac{\sum_{i=1}^{n}(x_i - \bar{x})(y_i-\bar{y})}{\sum_{i=1}^{n}(x_i-\bar{x})^2},\\ \hat{\beta_0} &= \bar{y}-\hat{\beta_1}\bar{x}, \end{aligned} \tag{2.4} \end{equation}\]

where \(\bar{y} \equiv \frac{1}{n}\sum_{i=1}^{n}y_i\) and \(\bar{x} \equiv \frac{1}{n}\sum_{i=1}^{n}x_i\) are the sample means. In other words, (2.4) defines the least squares coefficient estimates for simple linear regression.

2.1 displays the simple linear regression fit to the Advertising data, where \(\hat{\beta_0} = 7.03\) and \(\hat{\beta_1} = 0.0475\).

In other words, according to this approximation, an additional $1,000 spent on TV advertising is associated with selling approximately 47.5 additional units of the product.

In Figure 3.2, we have computed RSS for a number of values of \(\beta_0\) and \(\beta_1\), using the advertising data with sales as the response and TV as the predictor.

In each plot, the red dot represents the pair of least squares estimates \((\hat{\beta_0}, \hat{\beta_1})\) given by (2.4).

These values clearly minimize the RSS.

[FIGURE 3.2 HERE]

2.1.2 Assessing the Accuracy of the Coefficient Estimates

Recall from Equation (2.1) that we can assume that the true relationship between \(X\) and \(Y\) takes the form \(Y = f(X)+\epsilon\) for some unknown function \(f\), where \(\epsilon\) is a mean-zero random error term. If \(f\) is to be approximated by a linear function, then we can write this relationship as

\[\begin{equation} Y = \beta_0+\beta_1X + \epsilon. \tag{2.5} \end{equation}\]

Here \(\beta_0\) is the intercept term—that is, the expected value of \(Y\) when \(X=0\) and \(\beta_1\) is the slope—the average increase in \(Y\) associated with a one-unit increase in \(X\). The error term is a catch-all for what we miss with this simple model: the true relationship is probably not linear, there may be other variables that cause variation in \(Y\), and there may be measurement error. We typically assume that the error term is independent of \(X\).

The model given by (2.5) defines the population regression line, which is the best linear approximation to the true relationship between \(X\) and \(Y\).1 The least squares regression coefficient estimates (2.4) characterize the least squares line (2.2).

[FIGURE 3.3 HERE]

The left-hand panel of Figure 3.3 displays these two lines in a simple simulated example. We created 100 random Xs, and generated 100 corresponding Ys from the model

\[\begin{equation} Y = 2+3X+\epsilon \tag{2.6} \end{equation}\]

where \(\epsilon\) was generated from a normal distribution with mean zero. The red line in the left-hand panel of Figure 3.3 displays the true relationship, \(f(X) = 2 + 3X\), while the blue line is the least squares estimate based on the observed data. The true relationship is generally not known for real data, but the least squares line can always be computed using the coefficient estimates given in (2.4). In other words, in real applications, we hav eaccess to a set of observations from which we can compute the lease squares line; however, the population regression line is unobserved. In the right-hand panel of Figure 3.3 we have generated ten different data sets from the model given by (2.6) and plotted the corresponding ten least squares lines. Notice that different data sets generated from the same true model result in slightly different least squares lines, but the unobserved population regression line does not change.

At first glance, the difference between the population regression line and the least squares line may seem subtle and confusing.

We only have one data set, and so what does it mean that two different lines describe the relationship between the predictor and the response?

Fundamentally the concept of these two lines is a natural extension of the standard statistical approach of using information from a sample to estimate characteristics of a large population.

For example, suppose that we are interested in knowing the population mean \(\mu\) of some random variable \(Y\).

Unfortunately, \(\mu\) is unknoqn, but we do have access to \(n\) observations from \(Y\), which we can write as \(y_1, ..., y_n\), and which we can use to estimate \(\mu\).

A reasonable estimate is \(\hat{\mu} = \bar{y}\), where \(\bar{y} = \frac{1}{n}\sum^{n}_{i=1}{y_i}\) is the sample mean.

The sample mean and the population mean are different, but in general the sample mean will provide a good estimate of the population mean.

In the same way, the unknown coefficients \(\beta_0\) and \(\beta_1\) in linear regression define the population regression line.

We seek to estimate these unknown coefficients using \(\hat{\beta_0}\) and \(\hat{\beta_1}\) given in (2.4).

These coefficient estimates define the least squares line.

The analogy between linear regression and estimation of the mean of a random variable is an apt one based on the concept of bias.

If we use the sample mean \(\hat{\mu}\) to estimate \(\mu\), this estimate is unbiased, in the sense that on average, we expect \(\hat{\mu}\) to equal \(\mu\).

What exactly does this mean?

It means that on the basis of one particular set of observations \(y_1,...,y_n,\; \hat{\mu}\) might overestimate \(\mu\), and on the basis of another set of observations, \(\hat{\mu}\) might underestimate \(\mu\).

But if we could average a huge number of estimates of \(\mu\) obtained from a huge number of sets of observations, then this average would exactly equal \(\mu\).

Hence, an unbiased estimator does not _systematically) over- or under-estimate the true parameter.

The property of unbiasedness holds for the least squares coefficient estimates given by (2.4) as well: if we estimate \(\beta_0\) and \(\beta_1\) on the basis of a particular data set, then the average of these estimates would be spot on!

In fact, we can see from the right-hand panel on Figure 3.3 that the average of many least squares lines, each estimated from a separate data set, is pretty close to the true population regression line.

We continue the analogy with the estimation of the population mean \(\mu\) of a random variable \(Y\).

A natural question is as follows: how accurate is the sample mean \(\hat{\mu}\) as an estimate of \(\mu\)?

We have established that the average of \(\hat{\mu}\)’s over many data sets will be very close to \(\mu\), but that a single estimate \(\hat{\mu}\) may be a substantial underestimate or overestimate of \(\mu\).

How far off will that single estimate of \(\hat{\mu}\) be?

In general, we answer this question by computing the standard error of \(\hat{\mu}\), written as \(SE(\hat{\mu})\).

We have the well-known formula

\[\begin{equation} Var(\hat{\mu}) = SE(\hat{\mu})^2 = \frac{\sigma^2}{n} \tag{2.7} \end{equation}\]

where \(\sigma\) is the standard deviation of each of the realizations \(y_i\) of \(Y\).2 Roughly speaking, the standard error tells us the average amount that this estimate \(\hat{\mu}\) differs from the actual value of \(\mu\). Equation (2.7) also tells us how this deviation shrinks with n—themore observations we have, the smaller the standard error of \(\hat{\mu}\). In a similar vein, we can wonder how close \(\hat{\beta_0}\) and \(\hat{\beta_1}\) are to the true values \(\beta_0\) and \(\beta_1\)/ To compute the standard errors associated with \(\hat{\beta_0}\) and \(\hat{\beta_1}\), we use the following formulas:

\[\begin{equation} SE(\hat{\beta_0})^2 = \sigma^2 \left[ \frac{1}{n} + \frac{\bar{x}^2}{\sum_{i=1}^n (x_i - \bar{x})^2} \right] , \hspace{1cm} SE(\hat{\beta_1})^2 = \frac{\sigma^2}{\sum_{i=1}^n (x_i - \bar{x})^2} , \tag{2.8} \end{equation}\]

where \(\sigma^2 = Var(\epsilon)\). For these formulas to be strictly valid, we need to assume that the errors \(\epsilon_i\) for each observation are uncorrelated with common variance \(\sigma^2\). This is clearly not true in Figure 2.1, but the formula still turns out to be a good approximation. Notice in the formula that \(SE(\hat{\beta_1}\) is smaller when the \(x_i\) are more spread out; intuitively we have more leverage to estimate a slope when this is the case. We also see that \(SE(\hat{\beta_0})\) would be the same as \(SE(\hat{\mu})\) if \(\bar{x}\) were zero (in which case \(\hat{\beta_0}\) would be equal to \(\bar{y}\)). In general, \(\sigma^2\) is not known, but can be estimated from the data. The estimate of \(\sigma\) is known as the residual standard error, and is given by the formula \(RSE = \sqrt{RSS/(n-2)}\). Strictly speaking, when \(\sigma^2\) is estimated from the data we should write \(\widehat{SE}(\hat{\beta_1})\) to indicate that an estimate has been made, but for simplicity of notation we will drop this extra “hat”.

Standard errors can be used to compute confidence intervals. A 95% confidence interval is defined as a range of values such that with 95% probability, the range will contain the true unknown value of the parameter. The range is defined in terms of lower and upper limits computed from the sample of data. For linear regression, the 95% confidence interval for \(\beta_1\) approximately takes the form

\[\begin{equation} \hat{\beta_1} \pm 2 \cdot SE(\hat{\beta_1}). \tag{2.9} \end{equation}\]

That is, there is approximately a 95% chance that the interval

\[\begin{equation} \left[ \hat{\beta_1} - 2 \cdot SE(\hat{\beta_1}), \hat{\beta_1} + 2 \cdot SE(\hat{\beta_1}) \right] \tag{2.10} \end{equation}\]

will contain the true value of \(\beta_1\).3 Similarly, a confidence interval for \(\beta_0\) approximately takes the form

\[\begin{equation} \hat{\beta_0} \pm 2 \cdot SE(\hat{\beta_0}). \tag{2.11} \end{equation}\]

In the case of the advertising data, the 95% confidence interval for \(\beta_0\) is \([6.130, 7.935]\) and the 95% confidence interval for \(\beta_1\) is \([0.042, 0.053]\). Therefore, we can conclude that in the absence of any advertising, sales will, on average, fall somewhere between 6,130 and 7,940 units. Furthermore, for each $1,000 increase in television advertising, there will be an average increase in sales of between 42 and 53 units.

Standard errors can also be used to perform hypothesis tests on the coefficients. The most common hypothesis test involves testing the null hypothesis of

\[\begin{equation} H_0: \mathrm{There\ is\ no\ relationship\ between}\ X\ \mathrm{and}\ Y \tag{2.12} \end{equation}\]

versus the alternative hypothesis

\[\begin{equation} H_a: \mathrm{There\ is\ some\ relationship\ between}\ X\ \mathrm{and}\ Y. \tag{2.13} \end{equation}\]

Mathematically, this corresponds to testing

\[H_0: \beta_1 = 0\]

versus

\[H_a: \beta_1 \neq 0.\]

since if \(\beta_1 = 0\) then the model (2.5) reduces to \(Y = \beta_0 + \epsilon\), and \(X\) is not associated with \(Y\). To test the null hypothesis, we need to determine whether \(\hat{\beta_1}\), our estimate for \(\beta_1\), is sufficiently far from zero that we can be confident that \(\beta_1\) is non-zero. How far is enough? This of course depends on the accuracy of \(\hat{\beta_1}\)—that is, it depends on \(SE(\hat{\beta_1})\). If \(SE(\hat{\beta_1})\) is small, then even relatively small values of \(\hat{\beta_1}\) may provide strong evidence that \(\beta_1 \neq 0\), and hence that there is a relationship between \(X\) and \(Y\). In contrast, if \(SE(\hat{\beta_1})\) is large, then \(\hat{\beta_1}\) must be large in absolute value in order for us to reject the null hypothesis. In practice, we compute a t-statistic, give by

\[\begin{equation} t = \frac{\hat{\beta_1}-0}{SE(\hat{\beta_1})} , \tag{2.14} \end{equation}\]

which measures the number of standard deviations that \(\hat{\beta_1}\) is away from 0. If there really is no relationship between \(X\) and \(Y\), then we expect that (2.14) will have a t-distribution with \(n-2\) degrees of freedom. The t-distribution has a bell shape and for values of n greater than approximately 30 it is quite similar to the normal distribution. Consequently, it is a simple matter to compute the probability of observing any number equal to \(|t|\) or larger in absolute value, assuming \(\beta_1 = 0\). We call this probability the p-value. Roughly speaking, we interpret the p-value as follows: a small p-value indicates that it is unlikely to observe such a substantial association between the predictor and the response due to chance, in the absence of any real association between the predictor and the response. Hence, if we see a small p-value, then we can infer that there is an association between the predictor and the response. We reject the null hypothesis—that is, we declare a relationship to exist between \(X\) and \(Y\)—if the p-value is amll enough. Typical p-value cutoffs for rejecting the null hypothesis are 5 or 1%. When \(n=30\), these correspond to t-statistics (2.14) of around 2 and 2.75, respectively.

{ Table 3.1 goes here }

Table 3.1 provides details of the least squares model for the regression of number of units sold on TV advertising budget for the Advertising data.

Notice that the coefficients for \(\hat{\beta_0}\) and \(\hat{\beta_1}\) are very large relative to their standard errors, so the t-statistics are also large; the probabilities of seeing such values if \(H_0\) is true are virtually zero.

Hence we can conclude that \(\beta_0 \neq 0\) and \(\beta_1 \neq 0\).4

2.1.3 Assessing the Accuracy of the Model

Once we have rejected the null hypothesis (2.12) in favor of the alternative hypothesis (2.13), it is natural to want to quantify the extent to which the model fits the data. The quality of a linear regression fit is typically assessed using two related quantities: the residual standard error and the \(\color{#1188ce}{R^2}\) statistic.

Table 3.2 displays the RSE, the \(R^2\) statistic, and the F-statistic (to be described in Section 3.2.2) for the linear regression of number of units sold on TV advertising budget.

Residual Standard Error

Recall from the model (2.5) that associated with each observation is an error term \(\epsilon\). Due to the presence of these error terms, even if we knew the true regression line (i.e. even if \(\beta_0\) and \(\beta_1\) were known), we would not be able to perfectly predict \(Y\) from \(X\). The RSE is an estimate of the standard deviation of \(\epsilon\).

{Table 3.2 goes here}

Roughly speaking, it is the average amount that the response will deviate from the true regression line. It is computed using the formula

\[\begin{equation} RSE = \sqrt{\frac{1}{n-2}RSS} = \sqrt{\frac{1}{n-2} \sum_{i=1}^{n} (y_i - \hat{y_i})^2} . \tag{2.15} \end{equation}\]

Note that RSS was defined in Section 3.1.1, and is given by the formula

\[\begin{equation} RSS = \sum_{i=1}^{n} (y_i - \hat{y_i})^2 . \tag{2.16} \end{equation}\]

In the case of the advertising data, we see from the linear regression output in Table 3.2 that the RSE is 3.26.

In other words, actual sales in each market deviate from the true regression line by approximately 3,260 units, on average.

Another way to think about this is that even if the model were correct and the true values of the unknown coefficients \(\beta_0\) and \(\beta_1\) were known exactly, any prediction of sales on the basis of TV advertising would still be off by about 3,260 units on average.

Of course, whether or not 3,260 units is an acceptable prediction error depends on the problem context.

In the advertising data set, the mean value of sales over all markets is approximately 14,000 units, and so the percentage error is \(3,260/14,000 = 23\%\).

The RSE is considered a measure of the lack of fit of the model (2.5) to the data. If the predictions obtained using the model are very close to the true outcome values—that is, if \(\hat{y_i} \approx y_i\) for \(i = 1, ..., n\)—then (2.15) will be small, and we can conclude that the model fits the data very well. On the other hand, if \(\hat{y_i}\) is very far from \(y_i\) for one or more observations, then the RSE may be quite large, indicating that the model doesn’t fit the data well.

R2 Statistic

The RSE provides an absolute measure of lack of fit of the model (2.5) to the data. But since it is measured in the units of \(Y\), it is not always clear what constitutes a good RSE. The \(R^2\) statistic provides an alternative measure of fit. It takes the form of a proportion—the proportion of variance explained—and so it always takes on a value between 0 and 1, and is independent of the scale of \(Y\).

To calculate \(R^2\), we use the formula

\[\begin{equation} R^2 = \frac{TSS-RSS}{TSS} = 1 - \frac{RSS}{TSS} \tag{2.17} \end{equation}\]

where \(TSS = \sum (y_i - \bar{y})^2\) is the total sum of squares, and the RSS is defined in (2.16).

TSS measures the total variance in the response \(Y\), and can be thought of as the amount of variability inherent in the response before the regression is performed.

In contrast, RSS measures the amount of variability that is left unexplained after performing the regression.

Hence, \(TSS - RSS\) measures the amount of variability in the response that is explained (or removed) by performing the regression, and \(R^2\) measures the proportion of variability in Y that can be explained using X.

An \(R^2\) statistic that is close to 1 indicates that a large proportion of the variability in the response has been explained by the regression.

A number near 0 indicates that the regression did not explain much of the variability in the response; this might occur because the linear model is wrong, or the inherent error \(\sigma^2\) is high, or both.

In Table 3.2, the \(R^2\) was 0.61, and so just under two-thirds of the variability in sales is explained by a linear regression on TV.

The \(R^2\) statistic is a measure of the linear relationship between \(X\) and \(Y\). Recall that correlation, defined as

\[\begin{equation} Cor(X,Y) = \frac{\sum_{i=1}^{n}(x_i - \bar{x})(y_i - \bar{y})}{\sqrt{\sum_{i=1}^{n} (x_i - \bar{x})^2} \sqrt{\sum_{i=1}^{n} (y_i - \bar{y})^2}}, \tag{2.18} \end{equation}\]

is also a measure of the linear relationship between \(X\) and \(Y\).5 This suggests that we might be able to use \(r = Cor(X,Y)\) instead of \(R^2\) in order to assess the fit of the linear model. In fact, it can be shown that in the simple linear regression setting, \(R^2 = r^2\). In other words, the squared correlation and the \(R^2\) statistic are identical. However, in the next section we will discuss the multiple linear regression problem, in which we use several predictors simultaneously to predict the response. The concept of correlation between the predictors and the response does not extend automatically to this setting, since correlation quantifies the association between a single pair of variables rather than between a larger number of variables. We will see that \(R^2\) fills this role.

2.2 Multiple Linear Regression

Simple linear regression is a useful approach for predicting a response on the basis of a single predictor variable.

However, in practice we often have more than one predictor.

For example, in the Advertising data, we have examined the relationship between sales and TV advertising.

We also have data for the amount of money spent on advertising on the radio and in newspapers, and we may want to know whether either of these two media is associated with sales.

How can we extend our analysis of the advertising data in order to accommodate these two additional predictors?

One option is to run three separate simple linear regressions, each of which uses a different advertising medium as a predictor. For instance, we can fit a simple linear regression to predict sales on the basis of the amount spent on radio advertisements. Results are shown in Table 3.3 (top table). We find that a $1,000 increase in spending on radio advertising is associated with an increase in sales by around 203 units. Table 3.3 (bottom table) contains the least squares coefficients for a simple linear regression of sales onto newspaper advertising budget. A $1,000 increase in newspaper advertising budget is associated with an increase in sales by approximately 55 units.

However, the approach of fitting a separate simple linear regression model for each predictor is not entirely satisfactory. First of all, it is unclear how to make a single prediction of sales given levels of the three advertising media budgets, since each of the budgets is associated with a separate regression equation. Second, each of the three regression equations ignores the other two media in forming estimates for the regression coefficients. We will see shortly that if the media budgets are correlated with each other in the 200 markets that constitute our data set, then this can lead to very misleading estimates of the individual media effects on sales.

Instead of fitting a separate simple linear regression model for each predictor, a better approach is to extend the simple linear regression model (2.5) so that it can directly accommodate multiple predictors. We can do this by giving each predictor a separate slope coefficient in a single model. In general, suppose that we have p distinct predictors. Then the multiple linear regression model takes the form

\[\begin{equation} Y = \beta_0+\beta_1X_1 +\beta_2X_2 + ... +\beta_pX_p + \epsilon, \tag{2.19} \end{equation}\]

where \(X_j\) represents the jth predictor and \(\beta_j\) quantifies the association between that variable and the response. We interpret \(\beta_j\) as the average effect on \(Y\) of a one unit increase in \(X_j\), holding all other predictors fixed. In the advertising example, (2.19) becomes

\[\begin{equation} \color{#B44C1C}{\textbf{sales}} = \beta_0 + \beta_1 \times \color{#B44C1C}{\textbf{TV}}+\beta_2 \times \color{#B44C1C}{\textbf{radio}}+\beta_3 \times \color{#B44C1C}{\textbf{newspaper}}+ \epsilon. \tag{2.20} \end{equation}\]

2.2.1 Estimating the Regression Coefficients

As was the case in the simple linear regression setting, the regression coefficients \(\beta_0, \beta_1, ..., \beta_p\) in (2.19) are unknown, and must be estimated. Given estimates \(\hat{\beta_0}, \hat{\beta_1}, ..., \hat{\beta_p}\), we can make predictions using the formula

\[\begin{equation} \hat{y} = \hat{\beta_0}+\hat{\beta_1}x_1 +\hat{\beta_2}x_2 + ... +\hat{\beta_p}x_p + \epsilon, \tag{2.21} \end{equation}\]

The parameters are estimated using the same least squares approach that we saw in the context of simple linear regression. We choose \(\beta_0, \beta_1, ..., \beta_p\) to minimize the sum of squared residuals

\[\begin{equation} \begin{aligned} RSS &= \sum_{i=1}^{n} (y_i-\hat{y})^2 \\ &= \sum_{i=1}^{n} (y_i-\hat{\beta_0} - \hat{\beta_1}x_{i1} - \hat{\beta_2}x_{i2} - ... - \hat{\beta_p}x_{ip})^2. \end{aligned} \tag{2.22} \end{equation}\]

The values \(\hat{\beta_0}, \hat{\beta_1}, ..., \hat{\beta_p}\) that minimize (2.22) are the multiple least squares regression coefficient estimates.

Unlike the simple linear regression estimates given in (2.4), the multiple regression coefficient estimates have somewhat complicated forms that are most easily represented using matrix algebra.

For this reason, we do not provide them here.

Any statistical software package can be used to compute these coefficient estimates, and later in this chapter we will show how this can be done in R.

Figure 3.4 illustrates an example of the least squares fit to a toy data set with \(p = 2\) predictors.

Table 3.4 displays the multiple regression coefficient estimates when TV, radio, and advertising budgets are used to predict product sales using the Advertising data.

We interpret these results as follows: for a given amount of TV and newspaper advertising, spending an additional $1,000 on radio advertising leads to an increase in sales by approximately 189 units.

Comparing these coefficient estimates to those displayed in Table 3.1 and 3.3, we notice that the multiple regression coefficient estimates for TV and radio are pretty similar to the simple linear regression coefficient estimates.

However, while the newspaper regression coefficient estimate in Table 3.3 was significantly non-zero, the coefficient estimate for newspaper in the multiple regression model is close to zero, and the corresponding p-value is no longer significant, with a value around 0.86.

# estimate linear model

advertising_mlin_reg = lm(sales~TV+radio+newspaper, data = advertising)

# Clean up the model output

prep_reg_table(advertising_mlin_reg) %>%

# use reactable to produce the table

reactable(

borderless = T,

sortable = F,

defaultColDef = colDef(format = colFormat(digits = 3)),

# Specific column formats

columns = list(

term = colDef(

name = "",

style = list(borderRight = "2px solid black",

color = "#B44C1C",

fontFamily = "Roboto Mono"),

headerStyle = list(borderRight = "2px solid black")),

`t-statistic` = colDef(format = colFormat(digits = 2))

)

)

# Put the caption beneath the table

rt_caption(

text = str_c("For the ", data_colour("Advertising"), " data, least squares coefficient estimates of the multiple linear regression of number of units sold on radio, TV, and newspaper advertising budgets."),

tab_num = 3.4

)TABLE 3.4. For the Advertising data, least squares coefficient estimates of the multiple linear regression of number of units sold on radio, TV, and newspaper advertising budgets.

This illustrates that the simple and multiple regression coefficients can be quite different.

This difference stems from the fact that in the simple regression case, the slope term represents the average effect of a $1,000 increase in newspaper advertising, ignoring other predictors such as TV and radio.

In contrast, in the multiple regression setting, the coefficient for newspaper represents the average effect of increasing newspaper spending by $1,000 while holding TV and radio fixed.

Does it make sense for the multiple regression to suggest no relationship between sales and newspaper while the simple linear regression implies the opposite?

In fact it does.

Consider the correlation matrix for the three predictor variables and response variable, displayed in Table 3.5.

Notice that the correlation between radio and newspaper is 0.35.

This reveals a tendency to spend more on newspaper advertising in markets where more is spent on radio advertising.

Now suppose that the multiple regression is correct and newspaper advertising has no direct impact on sales, but radio advertising does increase sales.

Then in markets where we spend more on radio our sales will tend to be higher, and as our correlation matrix shows, we also tend to spend more on newspaper advertising in those same markets.

Hence, in a simple linear regression which only examines sales versus newspaper, we will observe that higher values of newspaper tend to be associated with higher values of sales, even though newspaper advertising does not actually affect sales.

So newspaper sales are a surrogate for radio advertising; newspaper gets “credit” for the effect of radio on sales.

This slightly counterintuitive result is very common in many real life situations.

Consider an absurd example to illustrate the point.

Running a regression of shark attacks versus ice cream sales for data collected at a given beach community over a period of time would show a positive relationship, similar to that seen between sales and newspaper.

Of course no one (yet) has suggested that ice creams should be banned at beaches to reduce shark attacks.

In reality, higher temperatures cause more people to visit the beach, which in turn results in more ice cream sales and more shark attacks.

A multiple regression of attacks versus ice cream sales and temperature reveals that, as intuition implies, the former predictor is no longer significant after adjusting for temperature.

2.2.2 Some Important Questions

When we perform multiple linear regression, we usually are interested in answering a few important questions.

Is at least one of the predictors \(X_1 , X_2 , ... , X_p\) useful in predicting the response?

Do all the predictors help to explain \(Y\), or is only a subset of the predictors useful?

How well does the model fit the data?

Given a set of predictor values, what response value should we predict, and how accurate is our prediction?

We now address each of these questions in turn.

2.2.2.1 One: Is There a Relationship Between the Response and Predictors?

Recall that in the simple linear regression setting, in order to determine whether there is a relationship between the response and the predictor we can simply check whether \(\beta_1 = 0\). In the multiple regression setting with \(p\) predictors, we need to ask whether all of the regression coefficients are zero, i.e. whether \(\beta_1 = \beta_2 = ... = \beta_p = 0\). As in the simple linear regression setting, we use a hypothesis test to answer this question. We test the null hypothesis,

\[H_0: \beta_1 = \beta_2 = ... = \beta_p = 0\]

versus the alternative

\[H_a: \mathrm{at\ least\ one\ \beta_j\ is\ non-zero}\]

This hypothesis test is performed by computing the F-statistic,

\[\begin{equation} F = \frac{(TSS-RSS)/p}{RSS/(n-p-1)}, \tag{2.23} \end{equation}\]

where, as with simple linear regression, \(TSS = \sum{(y_i - \bar{y})^2}\) and \(RSS = \sum{(y_i - \hat{y_i})^2}\). If the linear model assumptions are correct, one can show that

\[ E\{RSS/(n-p-1)\} = \sigma^2 \]

and that, provided \(H_0\) is true.

\[ E\{TSS-RSS/p\} = \sigma^2. \]

Hence, when there is no relationship between the response and predictors, one would expect the F-statistic to take on a value close to 1. On the other hand, if \(H_a\) is true, then $ E{TSS-RSS/p} > ^2 $, so we expect \(F\) t obe greater than 1.

The F-statistic for the multiple linear regression model obtained by regressing sales onto radio, TV, and newspaper is shown in Table 3.6.

In this example the F-statistic is 570.

Since this is far larger than 1, it provides compelling evidence against the null hypothesis \(H_0\).

In other words, the large F-statistic suggests that at least one of the advertising media must be related to sales.

However, what if the F-statistic had been closer to

1? How large does the F-statistic need to be before we can reject \(H_0\) and conclude that there is a relationship?

It turns out that the answer depends on the values of \(n\) and \(p\).

When \(n\) is large, an F-statistic that is just a little larger than 1 might still provide evidence against \(H_0\).

In contrast, a larger F-statistic is needed to reject \(H_0\) if \(n\) is small.

When \(H_0\) is true, and the errors \(\epsilon_i\) have a normal distribution, the F-statistic follows an F-distribution.6

For any given value of \(n\) and \(p\), any statistical software package can be used to compute the p-value associated with the F-statistic using this distribution.

Based on this p-value, we can determine whether or not to reject \(H_0\).

For the advertising data, the p-value associated with the F-statistic in Table 3.6 is essentially zero, so we have extremely strong evidence that at least one of the media is associated with increased sales.

In (2.23) we are testing \(H_0\) that all the coefficients are zero. Sometimes we want to test that a partiuclar subset of \(q\) of the coefficients are zero. This corresponds to a null hypothesis

\[H_0: \beta_{p-q+1} = \beta_{p-q+2} = ... = \beta_p = 0.\]

where for convenience we have put the variables chosen for omission at the end of the list. In this case we fit a second model that uses all the variables except those last \(q\). Suppose that the residual sum of squares for that model is \(RSS_0\). Then the appropriate F-statistic is

\[\begin{equation} F = \frac{(RSS_0 - RSS)/q}{RSS/(n-p-1)}. \tag{2.24} \end{equation}\]

Notice that in Table 3.4, for each individual predictor a t-statistic and a p-value were reported.

These provide information about whether each individual predictor is related to the response, after adjusting for the other predictors.

It turns out that each of these are exactly equivalent7 to the F-test that omits that single variable from the model, leaving all others in—i.e. \(q=1\) in (2.24).

So it reports the partial effect of adding that variable to the model.

For instance, as we discussed earlier, these p-values indicate that TV and radio are related to sales, but that there is no evidence that newspaper is associated with sales, in the presence of these two.

Given these individual p-values for each variable, why do we need to look at the overall F-statistic? After all, it seems likely that if any one of the p-values for the individual variables is very small, then at least one of the predictors is related to the response. However, this logic is flawed, especially when the number of predictors p is large.

For instance, consider an example in which \(p = 100\) and \(H_0: \beta_1 = \beta_2 = ... = \beta_p = 0\)is true, so no variable is truly associated with the response. In this situation, about 5% of the p-values associated with each variable (of the type shown in Table 3.4) will be below 0.05 by chance. In other words, we expect to see approximately five small p-values even in the absence of any true association between the predictors and the response. In fact, we are almost guaranteed that we will observe at least one p-value below 0.05 by chance! Hence, if we use the individual t-statistics and associated p-values in order to decide whether or not there is any association between the variables and the response, there is a very high chance that we will incorrectly conclude that there is a relationship. However, the F-statistic does not suffer from this problem because it adjusts for the number of predictors. Hence, if \(H_0\) is true, there is only a 5% chance that the F-statistic will result in a p-value below 0.05, regardless of the number of predictors or the number of observations.

The approach of using an F-statistic to test for any association between the predictors and the response works when \(p\) is relatively small, and certainly small compared to \(n\). However, sometimes we have a very large number of variables. If \(p > n\) then there are more coefficients \(\beta_j\) to estimate than observations from which to estimate them. In this case we cannot even fit the multiple linear regression model using least squares, so the F-statistic cannot be used, and neither can most of the other concepts that we have seen so far in this chapter. When \(p\) is large, some of the approaches discussed in the next section, such as forward selection, can be used. This high-dimensional setting is discussed in greater detail in Chapter 6.

2.2.2.2 Two: Deciding on Important Variables

As discussed in the previous section, the first step in a multiple regression analysis is to compute the F-statistic and to examine the associated p-value. If we conclude on the basis of that p-value that at least one of the predictors is related to the response, then it is natural to wonder which are the guilty ones! We could look at the individual p-values as in Table 3.4, but as discussed, if p is large we are likely to make some false discoveries. It is possible that all of the predictors are associated with the response, but it is more often the case that the response is only related to a subset of the predictors. The task of determining which predictors are associated with the response, in order to fit a single model involving only those predictors, is referred to as variable selection. The variable selection problem is studied extensively in Chapter 6, and so here we will provide only a brief outline of some classical approaches.

Ideally, we would like to perform variable selection by trying out a lot of different models, each containing a different subset of the predictors. For instance, if \(p = 2\), then we can consider four models: (1) a model containing no variables, (2) a model containing \(X_1\) only, (3) a model containing \(X_2\) only, and (4) a model containing both \(X_1\) and \(X_2\). We can then select the best model out of all the models that we have considered. How do we determine which model is best? Various statistics can be used to judge the quality of a model. These include \(\color{#1188ce}{Mallow's\ C_p}\), Akaike information criterion (AIC), Bayesian information criterion (BIC), and \(\color{#1188ce}{adjusted\ R^2}\)*. These are discussed in more detail in Chapter 6. We can also determine which model is best by plotting various model outputs, such as the residuals, in order to search for patterns.

Unfortunately, there are a total of \(2^p\) models that contain subsets of p variables. This means that even for moderate p, trying out every possible subset of predictors is infeasible. For instance, we saw that if p = 2, then there are \(2^2\) = 4 models to consider. But if p = 30, then we must consider \(2^30\) = 1,073,741824 models! This is not practical. Therefore, unless p is very small, we cannot consider all \(2^p\) models, and instead we need an automated and efficient approach to choose a smaller set of models to consider. There are three classical approaches for this task:

- Forward selection. We begin with the null model—a model that contains an intercept but no predictors. We then fit p simple linear regressions and add to the null model the variable that results in the lowest RSS. We then add to that model the variable that results in the lowest RSS for the new two-variable model. This approach is continued until some stopping rule is satisfied.

- Backward selection. We start with all variables in the model, and remove the variable with the largest p-value—that is, the variable that is the least statistically significant. The new (p - 1)-variable model is fit, and the variable with the largest p-value is removed. This procedure continues until a stopping rule is reached. For instance, we may stop when all remaining variables have a p-value below some threshold.

- Mixed selection.

This is a combination of forward and backward selection.

We start with no variables in the model, and as with forward selection, we add the variable that provides the best fit.

We continue to add variables one-by-one.

Of course, as we noted with the

Advertisingexample, the p-values for the variables can become larger as the new predictors are added to the model. Hence, if at any point the p-value for one of the variables in the model rises above a certain threshold, then we remove that variable from the model. We continue to perform these forward and backward steps until all variables in the model have a sufficiently low p-value, and all variables outside the model would have a large p-value if added to the model.

Backward selection cannot be used if p > n, while forward selection can always be used. Forward selection is a greedy approach, and might include variables early that later become redundant. Mixed selection can remedy this.

2.2.2.3 Three: Model Fit

Two of the most common numerical measures of model fit are the RSE and \(R^2\), the fraction of variance explained. These quantities are computed and interpreted in the same fashion as for simple linear regression.

Recall that in simple regression, \(R^2\) is the square of the correlation of the response and the variable. In multiple linear regression, it turns out that it equals Cor(Y, \(\hat{Y})^2\), the square of the correlation between the response and the fitted linear model; in fact one property of the fitted linear model is that it maximizes this correlation among all possible linear models.

An \(R^2\) value close to 1 indicates that the model explains a large portion of the variance in the response variable.

As an example, we saw in Table 3.6 that for the Advertising data, the model that uses all three advertising media to predict sales has an \(R^2\) of 0.8972.

On the other hand, the model that uses only TV and radio to predict sales has an \(R^2\) value of 0.89719.

In other words, there is a small increase in \(R^2\) if we include newspaper advertising in the model that already contains TV and radio advertising, even though we saw earlier that the p-value for newspaper advertising in Table 3.4 is not significant.

It turns out that \(R^2\) will always increase when more variables are added to the model, even if those variables are only weakly associated with the response.

This is due to the fact that adding another variable to the least squares equations must allow us to fit the training data (though not necessarily the testing data) more accurately.

Thus, the \(R^2\) statistic, which is also computed on the training data, must increase.

The fact that adding newspaper advertising to the model containing only TV and radio advertising leads to just a tiny increase in \(R^2\) provides additional evidence that newspaper can be dropped from the model.

Essentially, newspaper provides no real improvement in the model fit to the training samples, and its inclusion will likely lead to poor results on independent test samples due to overfitting.

In contrast, the model containing only TV as a predictor had an \(R^2\) of 0.61 (Table 3.2).

Adding radio to the model leads to a substantial improvement in \(R^2\).

This implies that a model that uses TV and radio expenditures to predict sales is substantially better than one that uses only TV advertising.

We could further quantify this improvement by looking at the p-value for the radio coefficient in a model that contains only TV and radio as predictors.

The model that contains only TV and radio as predictors has an RSE of 1.681, and the model that also contains newspaper as a predictor has an RSE of 1.686 (Table 3.6).

In contrast, the model that contains only TV has an RSE of 3.26 (Table 3.2).

This corroborates our previous conclusion that a model that uses TV and radio expenditures to predict sales is much more accurate (on the training data) than one that only uses TV spending.

Furthermore, given that TV and radio expenditures are used as predictors, there is no point in also using newspaper spending as a predictor in the model.

The observant reader may wonder how RSE can increase when newspaper is added to the model given that RSS must decrease.

In general RSE is defined as

\[\begin{equation} RSE = \sqrt{\frac{1}{n-p-1}RSS,} \tag{2.25} \end{equation}\]

which simplifies to (2.15) for a simple linear regression. Thus, models with more variables can have higher RSE if the decrease in RSS is small relative to the increaes in p.

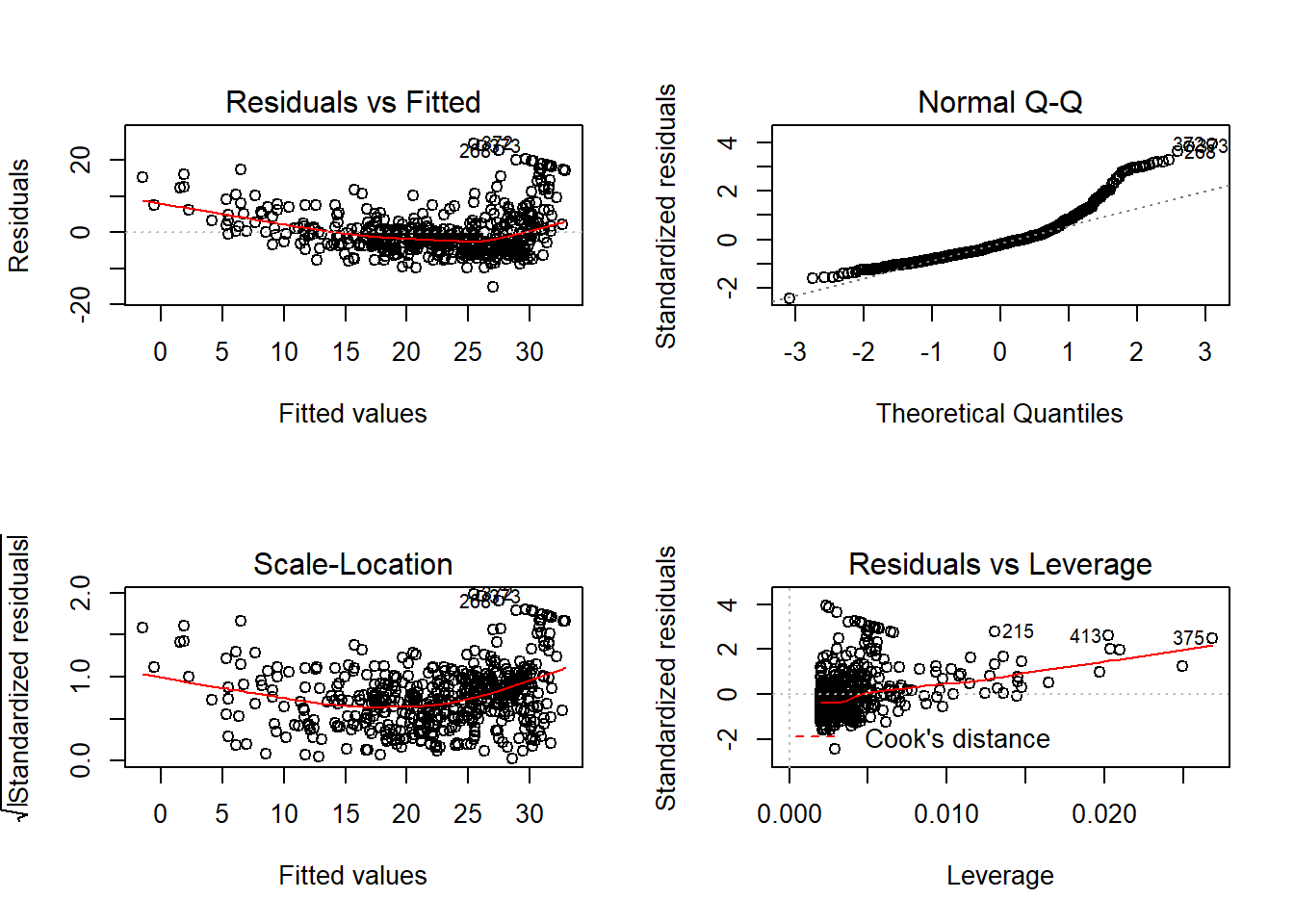

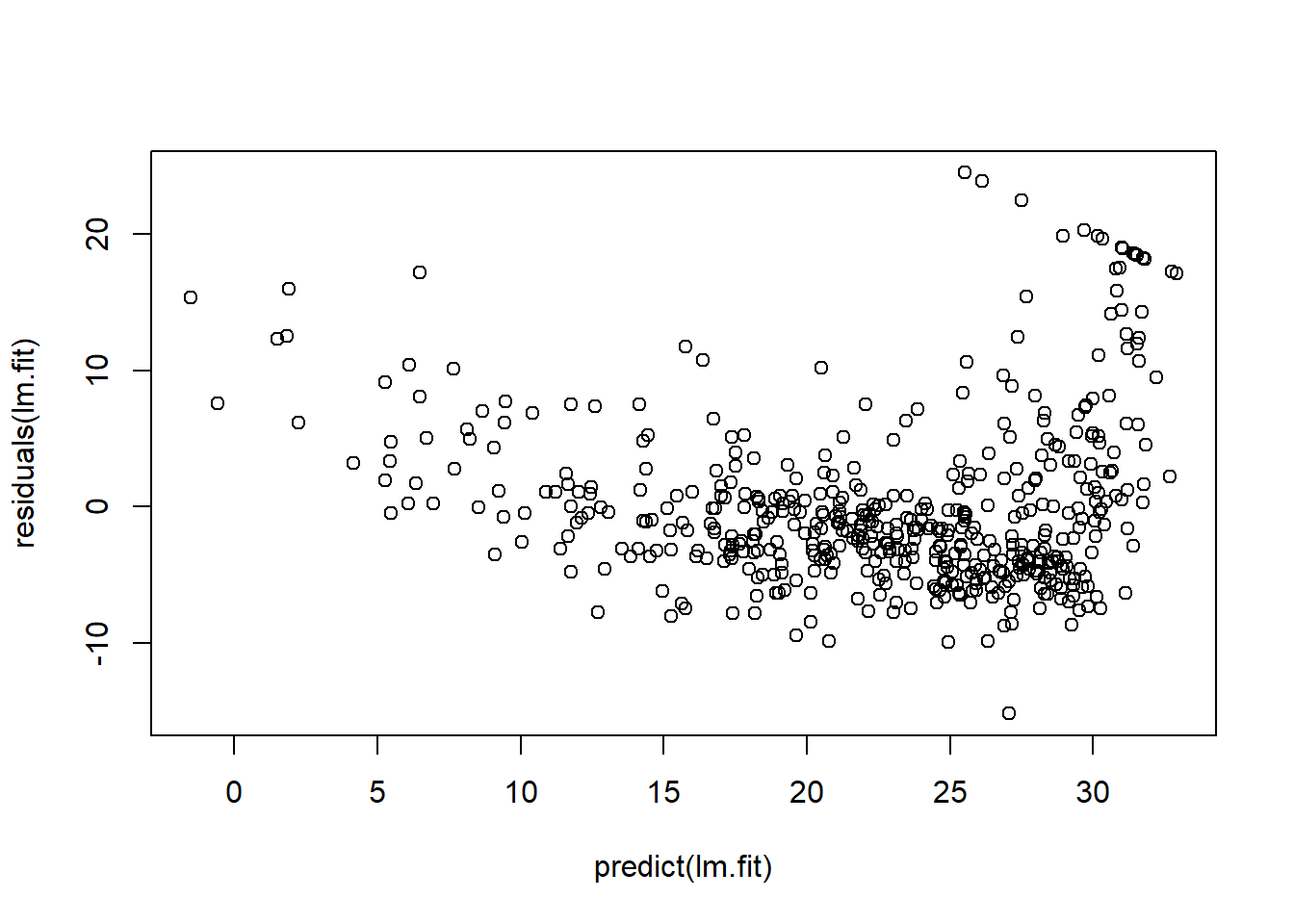

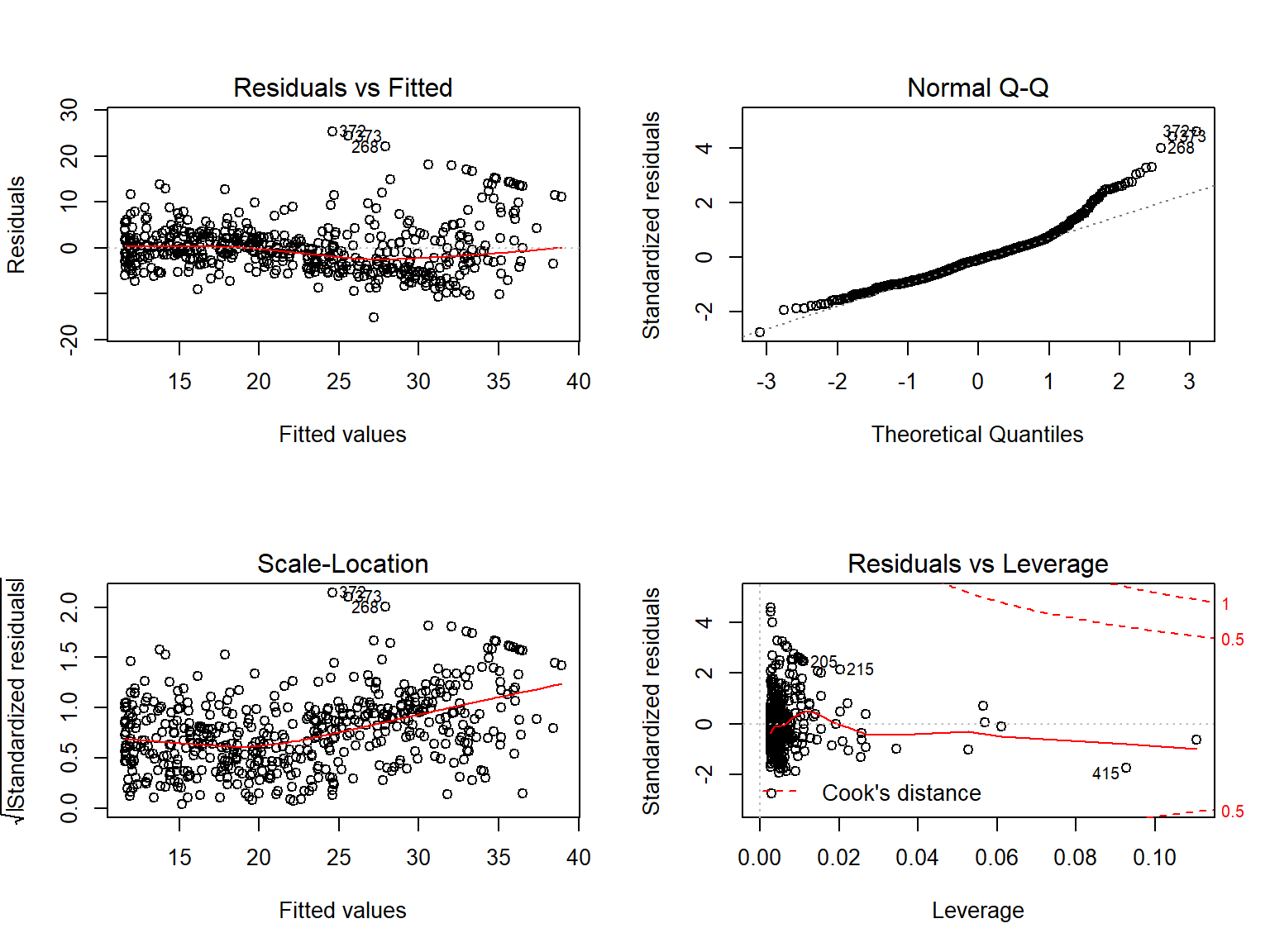

In addition to looking at the RSE and \(R^2\) statistics just discussed, it can be useful to plot the data.

Graphical summaries can reveal problems with a model that are not visible from numerical statistics.

For example, Figure 3.5 displays a three-dimensional plot of TV and radio versus sales.

We see that some observations lie above and some observations lie below the least squares regression plane.

In particular, the linear model seems to overestimate sales for instances in which most of the advertising money was spent exclusively on either TV or radio.

It underestimates sales for instances where the budget was split between the two media.

This pronounced non-linear pattern cannot be modeled accurately using linear regression.

It suggests a synergy or interaction effect between the advertising media, whereby combining the media together results in a bigger boost to sales than using any single medium.

In Section 3.3.2, we will discuss extending the linear model to accomodate such synergistic effects through the use of interaction terms.

2.2.2.4 Four: Predictions

Once we have fit the multiple regression model, it is straightforward to apply (2.21) in order to predict the response Y on the basis of a set of values for the predictors \(X_1, X_2,...,X_p\). However, there are three sorts of uncertainty associated with this prediction.

- The coefficient estimates \(\hat{\beta_0}, \hat{\beta_1}, ... , \hat{\beta_p}\) are estimates for \(\beta_0, \beta_1, ... , \beta_p\). That is, the least squares plane

\[ \hat{Y} = \hat{\beta_0} + \hat{\beta_1}X_1 + ... + \hat{\beta_p}X_p\]

is only an estimate for the true population regression plane

\[f(X) = \beta_0 + \beta_1 X1 + ... + \beta_p X_p.\]

The inaccuracy in the coefficient estimates is related to the reducible error from Chapter 2. We can compute a confidence interval in order to determine how close \(\hat{Y}\) will be to \(f(X)\).

Of course, in practice assuming a linear model for \(f(X)\) is almost always an approximation of reality, so there is an additional source of potentially reducible error which we call model bias. So when we use a linear model, we are in fact estimating the best linear approximation to the true surface. However, here we will ignore this discrepancy, and operate as if the linear model were correct.

Even if we knew \(f(X)\)—that is, even if we knew the true values for \(\beta_0, \beta_1,...,\beta_p\)—the response value cannot be predicted perfectly because of the random error in the model (2.21). In Chapter 2, we referred to this as the irreducible error. How much will Y vary from \(\hat{Y}\)? We use prediction intervals to answer this question. Prediction intervals are always wider than confidence intervals, because they incorporate both the error in the estimate for f(X) (the reducible error) and the uncertainty as to how much an individual point will differ from the population regression plane (the irreducible error).

We use a confidence interval to quantify the uncertainty surrounding the average sales over a large number of cities.

For example, given that $100,000 is spent on TV advertising and $20,000 is spent on radio advertising in each city, the 95% confidence interval is [10,985, 11,528].

We interpret this to mean that 95% of intervals of this form will contain the true value of f(X).8

On the other hand, a prediction interval can be used to quantify the uncertainty surrounding sales for a particular city.

Given that $100,000 is spent on TV advertising and $20,000 is spent on radio advertising in that city the 95% prediction interval is [7,930, 14,580].

We interpret this to mean that 95% of intervals of this form will contain the true value of Y for this city.

Note that both intervals are centered at 11,256, but that the prediction interval is substantially wider than the confidence interval, reflecting the increased uncertainty about sales for a given city in comparison to the average sales over many locations.

2.3 Other Considerations in the Regression Model

2.3.1 Qualitative Predictors

In our discussio so far, we have assumed that all variables in our linear regression model are quantitative.

But in practice, this is not necessarily the case; often some predictors are qualitative.

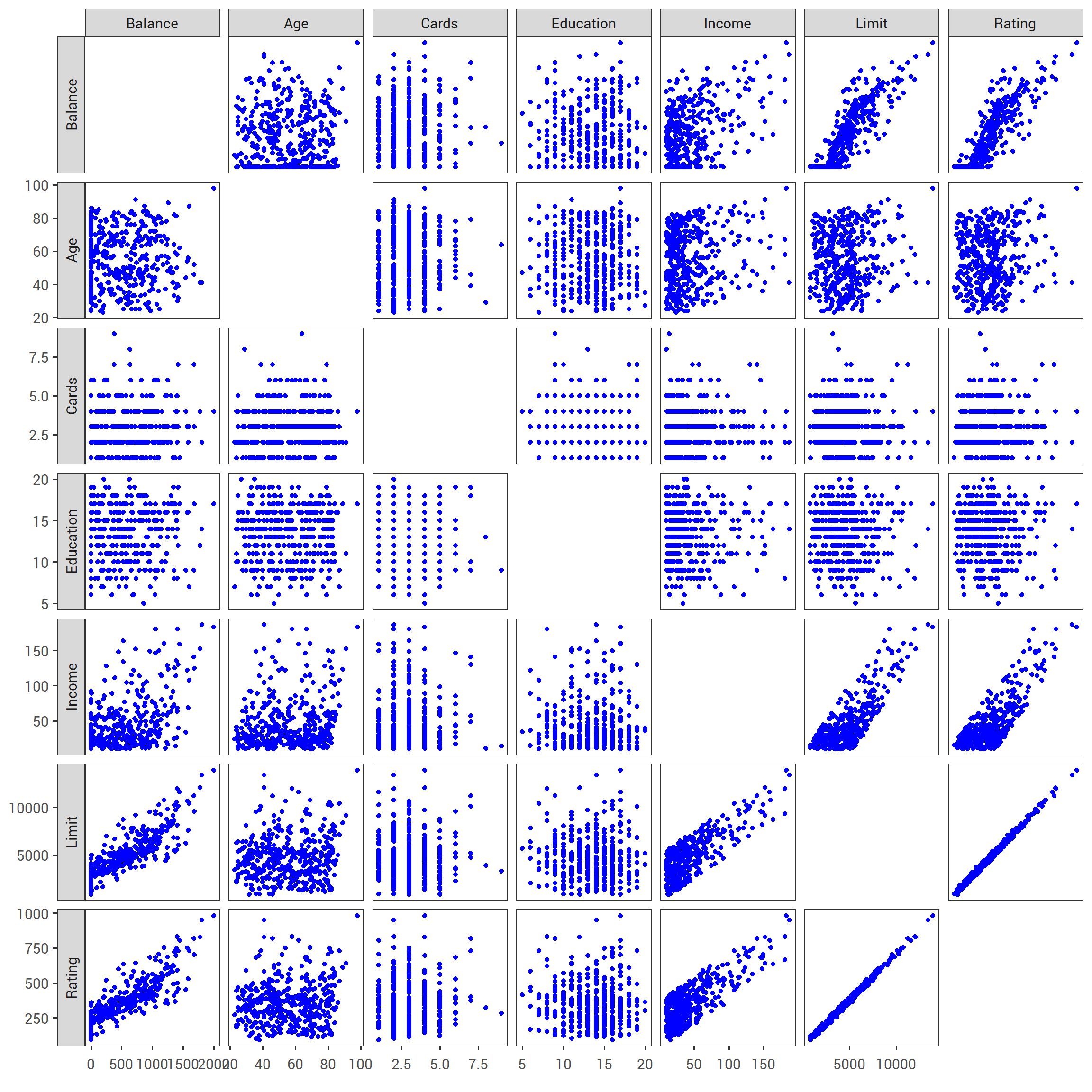

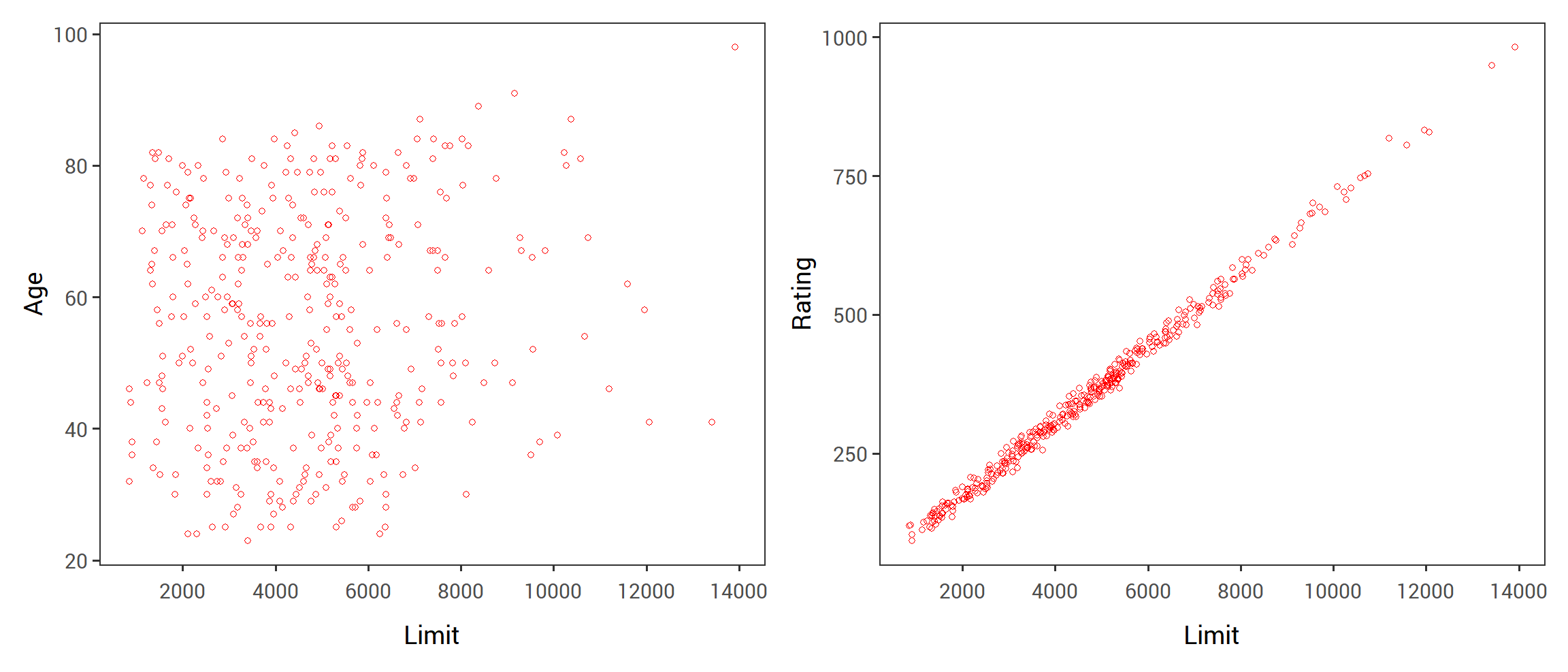

For example, the Credit data set displayed in Figure 3.6 records balance (average credit card debt for a number of individuals) as well as several quantitative predictors: age, cards (number of credit cards), education (years of education), income (in thousands of dollars), limit (credit limit), and rating (credit rating).

Each panel of Figure 3.6 is a scatterplot for a pair of variables whose identities are given by the corresponding row and column labels.

For example, the scatterplot directly to the right of the word “Balance” depicts balance versus age, while the plot directly to the right of “Age” corresponds to age versus cards.

In addition to these quantitative variables, we also have four qualitative variables: gender, student (student status), status (marital status), and ethnicity (Caucasian, African American or Asian).

# Need to use the GGally library

library(GGally)

# Select the relevant variables

ggpairs(select(credit, Balance, Age, Cards, Education, Income, Limit, Rating),

upper = list(continuous = wrap("points", colour = "blue")),

lower = list(continuous = wrap("points", colour = "blue")),

diag = "blank", # Set blank diagonal

axisLabels = "show",

switch = "y")+

# Apply our ISLR theme object

theme_islr()

FIGURE 2.2: The Credit data set contains information about balance , age , cards , education , income , limit , and rating for a number of potential customers.

TABLE 3.7

2.3.1.1 Predictors with Only Two Levels

Suppose that we wish to investigate differences in credit card balance between males and females, ignoring the other variables for the moment.

If a qualitative predictor (also known as a factor) only has two levels, or possible values, then incorporating it into a regression model is very simple.

We simply create an indicator or dummy variable that takes on two possible numerical values.

For example, based on the gender variable, we can create a new variable that takes the form

\[\begin{equation} x_i = \begin{cases} 1 & \text{if $i$th person is female}\\ 0 & \text{if $i$th person is male,}\\ \end{cases} \tag{2.26} \end{equation}\]

and use this variable as a predictor in the regression equation. This results in the model

\[\begin{equation} y_i = \beta_0 + \beta_1 x_i + \epsilon_i = \begin{cases} \beta_0 + \beta_1 + \epsilon_i & \text{if $i$th person is female}\\ \beta_0 + \epsilon_i & \text{if $i$th person is male.}\\ \end{cases} \tag{2.27} \end{equation}\]

Now \(\beta_0\) can be interpreted as the average credit card balance among males, \(\beta_0 + \beta_1\) as the average credit card balance among females, and \(\beta_1\) as the average difference in credit card balance between females and males.

Table 3.7 displays the coefficient estimates and other information associated with the model (2.27). The average credit card debt for males is estimated to be $509.80, whereas females are estimated to carry $19.73 in additional debt for a total of $509.80 + $19.73 = $529.53. However, we notice that the p-value for the dummy variable is very high. This indicates that there is no statistical evidence of a difference in average credit card balance between the genders.

The decision to code females as 1 and males as 0 in (2.27) is arbitrary, and has no effect on the regression fit, but does alter the interpretation of the coefficients. If we had coded males as 1 and females as 0, then the estimates for \(\beta_0\) and \(\beta_1\) would have been 529.53 and 19.73, respectively, leading once again to a prediction of credit card debt of $529.53 for females. Alternatively, instead of a 0/1 coding scheme, we could create a dummy variable

\[ x_i = \begin{cases} 1 & \text{if $i$th person is female}\\ -1 & \text{if $i$th person is male,}\\ \end{cases} \]

and use this variable in the regression equation. This results in the model

\[ y_i = \beta_0 + \beta_1 x_i + \epsilon_i = \begin{cases} \beta_0 + \beta_1 + \epsilon_i & \text{if $i$th person is female}\\ \beta_0 - \beta_1 + \epsilon_i & \text{if $i$th person is male.}\\ \end{cases} \]

Now \(\beta_0\) can be interpreted as the overall average credit card balance (ignoring the gender effect), and \(\beta_1\) is the amount that females are above the average and males are below the average. In this example, the estimate for \(\beta_0\) would be \(\$519.665\), halfway between the male and female averages of \(\$509.80\) and \(\$529.53\). The estimate for \(\beta_1\) would be \(\$9.865\), which is half of \(\$19.73\), the average difference between females and males. It is important to note that the final predictions of the credit balances of males and females will be identical regardless of the coding scheme used. The only difference is in the way that the coefficients are interpreted.

2.3.1.2 Qualitative Predictors with More than Two Levels

When a qualitative predictor has more than two levels, a single dummy variable cannot represent all possible values.

In this situation, we can create additional dummy variables.

For example, for the ethnicity variable we create two dummy variables. The first could be

\[\begin{equation} x_i1 = \begin{cases} 1 & \text{if $i$th person is Asian}\\ 0 & \text{if $i$th person is not Asian}\\ \end{cases} \tag{2.28} \end{equation}\]

and the second could be

\[\begin{equation} x_i2 = \begin{cases} 1 & \text{if $i$th person is Caucasian}\\ 0 & \text{if $i$th person is not Caucasian}\\ \end{cases} \tag{2.29} \end{equation}\]

Then both of these variables can be used in the regression equation, in order to obtain the model

\[\begin{equation} y_i = \beta_0 + \beta_1 x_i1 + \beta_2 x_i2 + \epsilon_i = \begin{cases} \beta_0 + \beta_1 + \epsilon_i & \text{if $i$th person is Asian}\\ \beta_0 + \beta_2 + \epsilon_i & \text{if $i$th person is Caucasian}\\ \beta_0 + \epsilon_i & \text{if $i$th person is African American.}\\ \end{cases} \tag{2.30} \end{equation}\]

Now \(\beta_0\) can be interpreted as the average credit card balance for African Americans, \(\beta_1\) can be interpreted as the difference in average balance between the Asian and African American categories, and \(\beta_2\) can be interpreted as the difference in the average balance between the Caucasian and African American categories. There will always be one fewer dummy variables than the number of levels. The level with no dummy variable — African American in this example — is known as the baseline.

TABLE 3.8

From Table 3.8, we see that the estimated balance for the baseline, African American is \(\$531.00\).

It is estimated that the Asian category will have \(\$18.69\) less debt than the African American category, and that the Caucasian category will have \(\$12.50\) less debt than the African American category.

However, the p-values associated with the coefficient estimates for the two dummy variables are very large, suggesting no statistical evidence of a real difference in credit card balance between the ethnicities.

Once again, the level selected as the baseline category is arbitrary, and the final predictions for each group will be the same regardless of this choice.

However, the coefficients and their p-values do depend on the choice of dummy variable coding.

Rather than rely on the individual coefficients, we can use an F-test to test \(H_0 : \beta_1 = \beta_2 = 0\); this does not depend on the coding.

This F-test has a p-value of \(0.96\), indicating that we cannot reject the null hypothesis that there is no relationship between balance and ethnicity.

Using this dummy variable approach presents no difficulties when using both quantitative and qualitative predictors.

For example, to regress balance on both a quantitative variable such as income and a qualitative variable such as student, we must simply create a dummy variable for student and then fit a multiple regression model using income and the dummy variable as predictors for credit card balance.

There are many different ways of coding qualitative variables besides the dummy variable approach taken here. All of these approaches lead to equivalent model fits, but the coefficients are different and have different interpretations, and are designed to measure particular contrasts. This topic is beyond the scope of the book, and so we will not pursue it further.

2.3.2 Extensions of the Linear Model

The standard linear regression model (2.19) provides interpretable results and works quite well on many real-world problems. However, it makes several highly restrictive assumptions that are often violated in practice. Two of the most important assumptions state that the relationship between the predictors and response are additive and linear. The additive assumption means that the effect of changes in a predictor \(X_j\) on the response \(Y\) is independent of the values of the other predictors. The linear assumption states that the change in the response \(Y\) due to a one-unit change in \(X_j\) is constant, regardless of the value of \(X_j\). In this book, we examine a number of sophisticated methods that relax these two assumptions. Here, we briefly examine some common classical approaches for extending the linear model.

2.3.2.1 Removing the Additive Assumption

In our previous analysis of the Advertising data, we concluded that both TV and radio seem to be associated with sales. The linear model that forms the basis for this conclusion assumed that the effect on sales of increasing one advertising medium is independent of the amount spent on the other media. For example, the linear model ((2.20)) states that the average effect on sales of a one-unit increase in TV is always \(\beta_1\), regardless of the amount spent on radio.

However, this simple model may be incorrect. Suppose that spending money on radio advertising actually increases the effectiveness of TV advertising, so that the slope term for TV should increase as radio increases. In this situation, given a fixed budget of \(\$100,000\), spending half on radio and half on TV may increaes sales more than allocating the entire amount to either TV or to radio. In marketing, this is known as a synergy effect, and in statistics it is referred to as an interaction effect. Figure 3.5 suggests that such an effect may be present in the advertising data. Notice that when levels of either TV or radio are low, then the true sales are lower than predicted by the linear model. But when advertising is split between the two media, then the model tends to underestimate sales.

Consider the standard linear regression model with two variables.

\[Y = \beta_0 + \beta_1 X_1 + \beta_2 X_2 + \epsilon\]

According to this model, if we increase X_1 by one unit, then \(Y\) will increase by an average of \(\beta_1\) units. Notice that the presence of \(X_2\) does not alter this statement — that is, regardless of the value of \(X_2\), a one-unit increase in \(X_1\) will lead to a \(\beta_1\)-unit increase in \(Y\). One way of extending this model to allow for interaction effects is to include a third predictor, called an interaction term, which is constructed by computing the product of \(X_1\) and \(X_2\). This results in the model

\[\begin{equation} Y = \beta_0 + \beta_1 X_1 + \beta_2 X_2 + \beta_3 X_1 X_2 + \epsilon \tag{2.31} \end{equation}\]

How does inclusion of this interaction term relax the additive assumption? Notice that (2.31) can be rewritten as

# estimate the linear model

interaction_model = lm(sales ~ TV+radio+TV*radio,

data = advertising)

# Clean up the model output

prep_reg_table(interaction_model) %>%

# use reactable to produce the table

reactable(

borderless = T,

sortable = F,

defaultColDef = colDef(format = colFormat(digits = 3)),

# Specific column formats

columns = list(

term = colDef(

name = "",

style = list(borderRight = "2px solid black",

color = "#B44C1C",

fontFamily = "Roboto Mono"),

headerStyle = list(borderRight = "2px solid black")),

`t-statistic` = colDef(format = colFormat(digits = 2))

)

)

# Put the caption beneath the table

rt_caption(

text = str_c("For the ", data_colour("Advertising"), " data, least squares coefficient estimates associated with the regression of ", data_colour("sales"), " onto ", data_colour("TV"), " and ", data_colour("radio"), ", with an interaction term, as in (3.33)"),

tab_num = 3.9

)TABLE 3.9. For the Advertising data, least squares coefficient estimates associated with the regression of sales onto TV and radio, with an interaction term, as in (3.33)

\[\begin{equation} \begin{aligned} Y &= \beta_0 + (\beta_1 + \beta_3 X_2) X_1 + \beta_2 X_2 + \epsilon \\ &= \beta_0 + \tilde{\beta_1} X_1 + \beta_2 X_2 + \epsilon \end{aligned} \tag{2.32} \end{equation}\]

where \(\tilde{\beta_1} = \beta_1 + \beta_3 X_2\). Since \(\tilde{\beta_1}\) changes with \(X_2\), the effect of \(X_1\) on \(Y\) is no longer constant: adjusting \(X_2\) will change the impact of \(X_1\) on \(Y\).

For example, suppose we are interested in studying the productivity of a factory. We wish to predict the number of units produced on the basis of the number of production lines and the total number of workers. It seems likely that the effect of increasing the number of production lines will depend on the number of workers, since if no workers are available to operate the lines, then increasing the number of lines will not increase production. This suggests that it would be appropriate to include an interaction term between lines and workers in a linear model to predict units. Suppose that when we fit the model, we obtain

\[ \begin{aligned} \color{#B44C1C}{units} &\approx 1.2 + 3.4 \times \color{#B44C1C}{workers} + 1.4 \times (\color{#B44C1C}{{lines}} \times \color{#B44C1C}{{workers}}) \\ &= 1.2 + (3.4 + 1.4 \times \color{#B44C1C}{{workers}}) \times \color{#B44C1C}{{lines}} + 0.22 \times \color{#B44C1C}{{workers}}. \end{aligned} \]

In other words, adding an additional line will increase the number of units produced by \(3.4 + 1.4 \times \color{#B44C1C}{workers}\). Hence the more workers we have, the stronger the effect of lines will be.

We now return to the Advertising example. A linear model that uses radio, TV, and an interaction between the two to predict sales takes the form

\[\begin{equation} \begin{aligned} \color{#B44C1C}{sales} &\approx \beta_0 + \beta_1 \times \color{#B44C1C}{TV} + \beta_2 \times \color{#B44C1C}{radio} + \beta_3 \times (\color{#B44C1C}{{radio}} \times \color{#B44C1C}{{TV}}) + \epsilon \\ &= \beta_0 + (\beta_1 + \beta_3 \times \color{#B44C1C}{radio}) \times \color{#B44C1C}{TV} + \beta_2 \times \color{#B44C1C}{radio} + \epsilon. \end{aligned} \tag{2.33} \end{equation}\]

We can interpret \(\beta_3\) as the increase in effectiveness of TV advertising for a one-unit increase in radio advertising (or vice-versa). The coefficients that result from fitting the model (2.33) are given in Table 3.9.

The results in Table 3.9 strongly suggest that the model that includes the interaction term is superior to the model that contains only main effects.

The p-value for the interaction term TV\(\times\)radio, is extremely low, indicating there is strong evidence for \(H_a : \beta_3 \neq 0\).

In other words, it is clear that the true relationship is not additive.

The \(R^2\) for the model (2.33) is \(96.8\%\), compared to only \(89.7\%\) for the model that predicts sales using TV and radio without an interaction term.

This means that \((96.8 - 89.7)/(100 - 89.7) = 69\%\) of the variability in sales that remains after fitting the additive model has been explained by the interaction term.

The coefficient estimates in Table 3.9 suggest that an increase in TV advertising of \(\$1,000\) is associated with increased sales of \((\hat{\beta_1} + \hat{\beta_3} \times \color{#B44C1C}{radio}) \times 1,000 = 19 + 1.1 \times \color{#B44C1C}{radio}\) units.

And an increase in radio advertising of \(\$1,000\) will be associated with an increase in sales of \((\hat{\beta_2} + \hat{\beta_3} \times \color{#B44C1C}{TV}) \times 1,000 = 29 + 1.1 \times \color{#B44C1C}{TV}\) units.

In this example, the p-values associated with TV, radio, and the interaction term all are statistically significant (Table 3.9), and so it is obvious that all three variables should be included in the model.

However, it is sometimes the case that an interaction term has a very small p-value, but the associated main effects (in this case, TV and radio) do not.

The hirearchical principle states that if we include an interaction in a model, we should also include the main effects, even if the p-values associated with their coefficients are not significant.

In other words, if the interaction between \(X_1\) and \(X_2\) seems important, then we should include both \(X_1\) and \(X_2\) in the model even if their coefficient estimates have large p-values.

The rationale for this principle is that if \(X_1 \times X_2\) is related to the response, then whether or not the coefficients of \(X_1\) or \(X_2\) are exactly zero is of little interest.

Also \(X_1 \times X_2\) is typically correlated with \(X_1\) and \(X_2\), and so leaving them out tends to alter the meaning of the interaction.

In the previous example, we considered an interaction between TV and radio, both of which are quantitative variables.

However, the concept of interactions applies just as well to qualitative variables.

In fact, an interaction between a qualitative variable and a quantitative variable has a particularly nice interpretation.

Consider the Credit data set from Section 3.3.1, and suppose that we wish to predict balance using the income (quantitative) and student (qualitative) variables.

In the absence of an interaction term, the model takes the form

\[\begin{equation} \begin{aligned} \color{#B44C1C}{balance}_i &\approx \beta_0 + \beta_1 \times \color{#B44C1C}{income}_i + \begin{cases} \beta_2 & \text{if $i$th person is a student}\\ 0 & \text{if $i$th person is not a student}\\ \end{cases} \\ &= \beta_1 \times \color{#B44C1C}{income}_i + \begin{cases} \beta_0 + \beta_2 & \text{if $i$th person is a student}\\ \beta_0 & \text{if $i$th person is not a student}\\ \end{cases} \end{aligned} \tag{2.34} \end{equation}\]

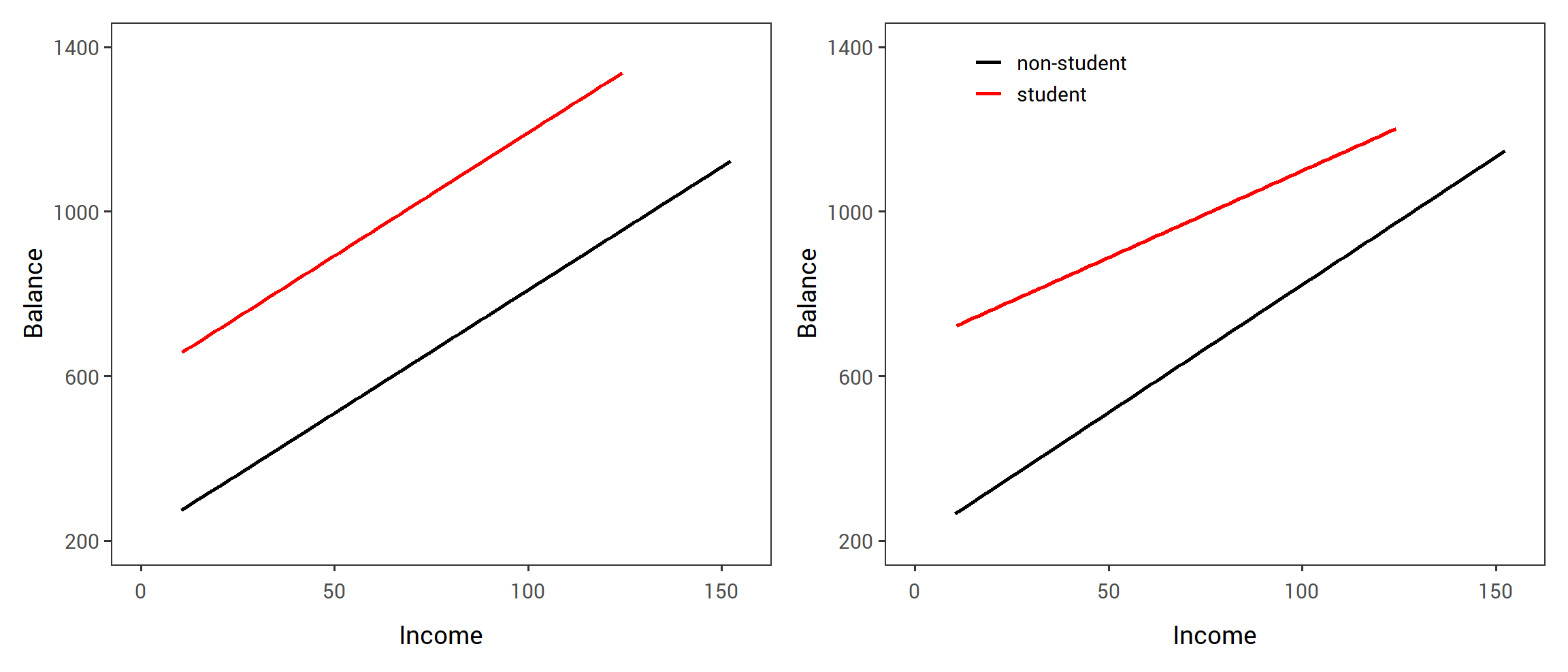

Notice that this amounts to fitting two parallel lines to the data, one for students and one for non-students.

The lines for students and non-students have different intercepts, \(\beta_0 + \beta_2\) versus \(\beta_0\), but the same slope, \(\beta_1\).

This is illustrated in the left-hand panel of Figure 3.7.

The fact that the lines are parallel means that the average effect on balance of a one-unit increase in income does not depend on whether or not the individual is a student.

This represents a potentially serious limitation of the model, since in fact a change in income may have a very different effect on the credit card balance of a student versus a non-student.

This limitation can be addressed by adding an interaction variable, created by multiplying income with the dummy variable for student.

Our model now becomes

\[\begin{equation} \begin{aligned} \color{#B44C1C}{balance}_i &\approx \beta_0 + \beta_1 \times \color{#B44C1C}{income}_i + \begin{cases} \beta_2 + \beta_3 \times \color{#B44C1C}{income}_i & \text{if student}\\ 0 & \text{if not student}\\ \end{cases} \\ &= \begin{cases} (\beta_0 + \beta_2) + (\beta_1 + \beta_3) \times \color{#B44C1C}{income}_i & \text{if student}\\ \beta_0 + \beta_1 \times \color{#B44C1C}{income}_i & \text{if not student}\\ \end{cases} \end{aligned} \tag{2.35} \end{equation}\]

Once again, we have two different regression lines for the students and the non-students.

But now those regression lines have different intercepts, \(\beta_0 + \beta_2\) versus \(\beta_0\), as well as different slopes, \(\beta_1 + \beta_3\) versus \(\beta_1\).

This allows for the possibility that changes in income may affect the credit card balances of students and non-students differently.

The right-hand panel of Figure 3.7 shows the estimated relationships between income and balance for students and non-students in (2.35).

We note that the slope for students is lower than the slope for non-students.

This suggests that increases in income are associated with smaller increases in credit card balance among students as compared to non-students.

# glimpse(Credit)

# create multiple linear model

credit_lm = lm(Balance~Income+Student, data = credit)

# summary(credit_lm)

# set axes and colour scale

cred_x_axis = scale_x_continuous(breaks = c(0, 50, 100, 150),

limits = c(0, 155))

cred_y_axis = scale_y_continuous(name = "Balance",

breaks = c(200, 600, 1000, 1400),

limits = c(200, 1400))

cred_colour_scale = scale_colour_manual(name = NULL,

values = c("black","red"))

credit_no_interaction = credit %>%

mutate(balance_pred = predict(credit_lm, credit)) %>%

ggplot(., aes(x = Income, y = balance_pred, colour = Student))+

stat_smooth(method = "lm", se = F)+

cred_x_axis+

cred_y_axis+

cred_colour_scale+

theme_islr()+

theme(legend.position = "none")

# create multiple linear model w/interaction

credit_lm_int = lm(Balance~Income+Student+Income*Student, data = credit)

# summary(credit_lm_int)

credit_interaction = credit %>%

mutate(balance_pred = predict(credit_lm_int, credit)) %>%

ggplot(., aes(x = Income, y = balance_pred, colour = Student))+

stat_smooth(method = "lm", se = F)+

cred_x_axis+

cred_y_axis+

cred_colour_scale+

theme_islr()+

theme(legend.position = c(.25, .91), legend.margin = margin())

credit_no_interaction + credit_interaction+

plot_layout(nrow = 1, widths = c(.5, .5))

FIGURE 2.3: For the Credit data, the least squares lines are shown for prediction of balance from income for students and non-students. Left: The model (3.34) was fit. There is no interaction between income and student. Right: The model (3.35) was fit. There is an interaction term between income and student.

2.3.2.2 Non-linear Relationships

As discussed previously, the linear regression model (2.19) assumes a linear relationship between the response and predictors. But in some cases, the true relationship between the response and the predictors may be non-linear. Here we present a very simple way to directly extend the linear model to accommodate non-linear relationships, using polynomial regression. In later chapters, we will present more complex approaches for performing non-linear fits in more general settings.

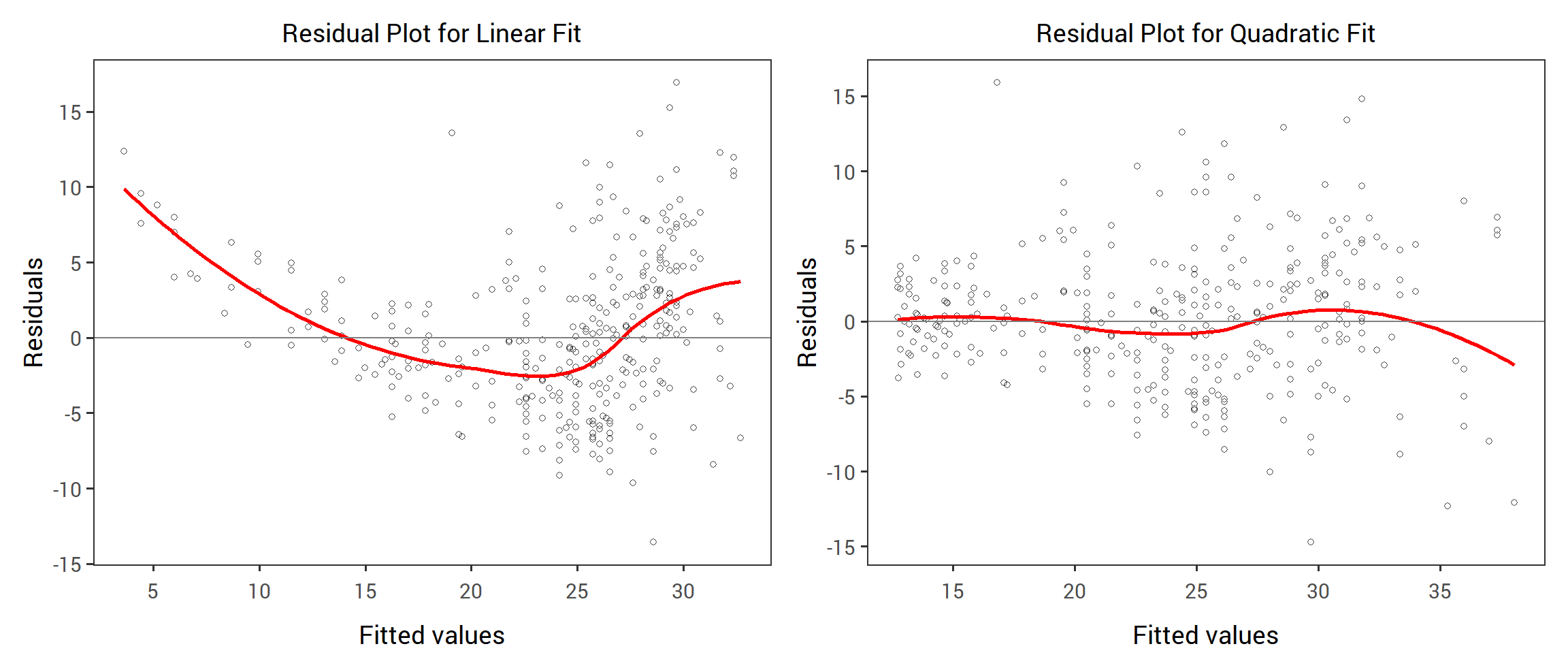

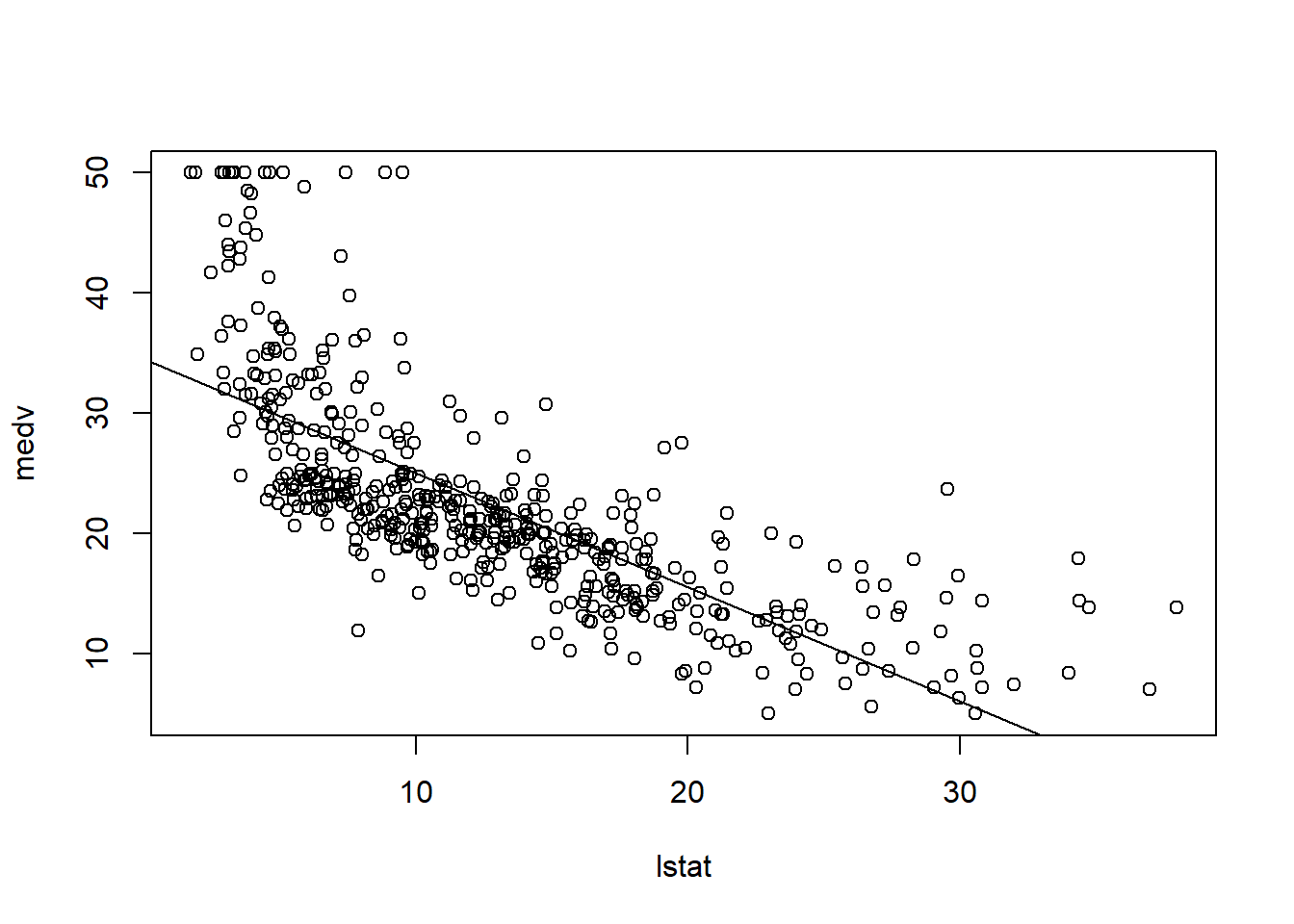

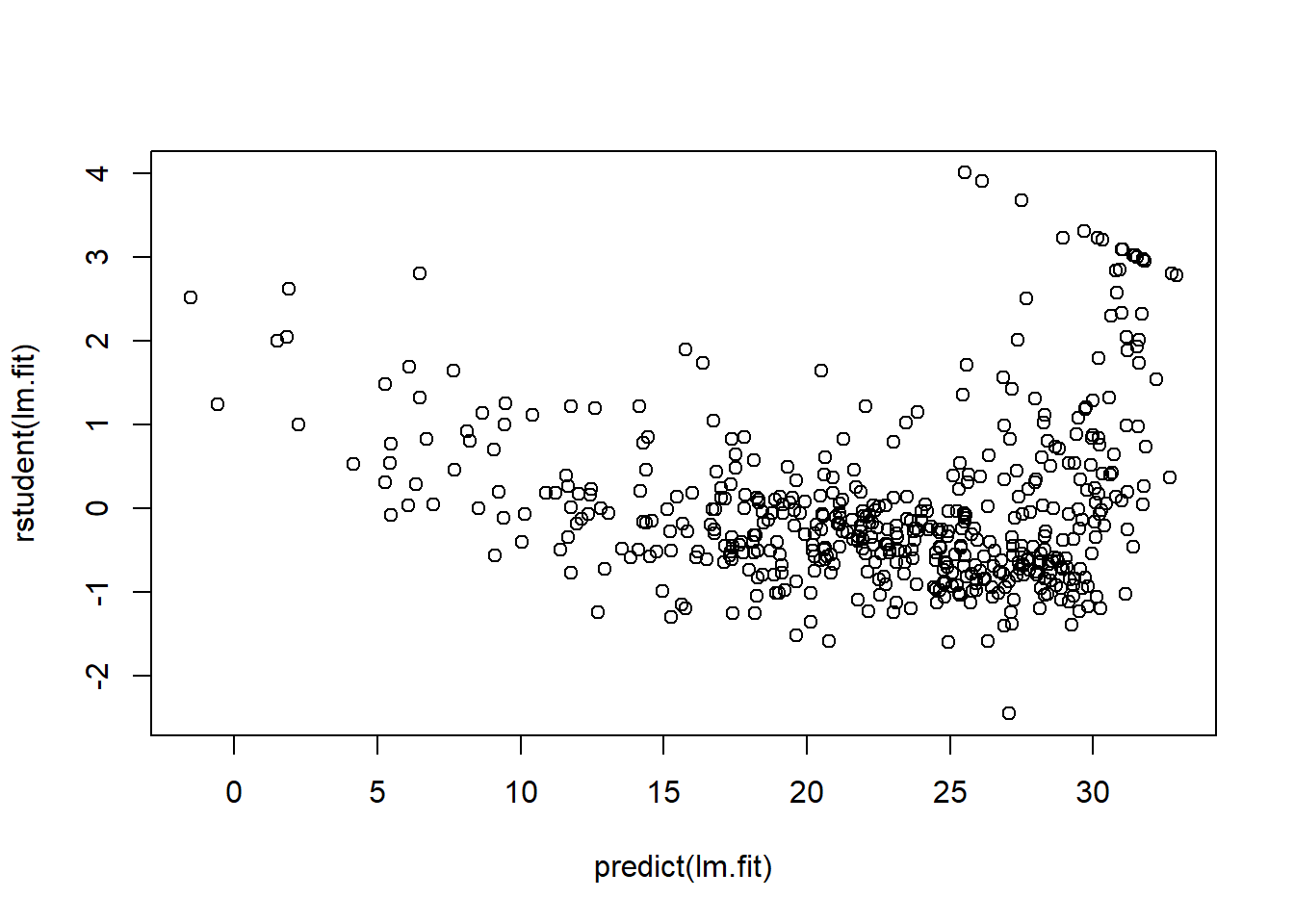

Consider Figure 3.8, in which the mpg (gas mileage in miles per gallon) versus horsepower is shown for a number of cars in the Auto data set.

FIGURE 3.8

The orange line represents the linear regression fit.